Ok so having gone through Wealth Wednesday Stage 1: Awareness you should know:

- Which Wealth Wednesday Financial Intelligence Stage you are at.

- Your credit score – and if the credit agencies have all the correct information to maximize your credit score

- Your personal net worth logged on Xero or similar.

- Your good and bad debt ordered in priority of repayment

So now we have drawn a line in the sand as to where you are – the more exciting stuff gets going and start planning for where you want to be. If you know which stage you are at now- which stage do you want to be at in a week, month, year, 5years? The ultimate aim is to achieve Wealth Wednesday Financial Intelligence Stage 1 “Financial Freedom” but Rome wasn’t built in a day! so its important to put realistic goals and targets in place ( and write them down/review them regularly)

Our mission is to get all of our new team members to at least Wealth Wednesday Financial Intelligence Stage 5 “Financial Control” as quickly as possible. This we feel gets everyone to a solid base foundation level of financial intelligence with which to go on and learn about individual investments etc.

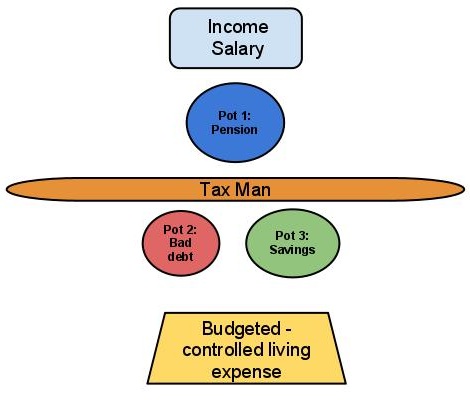

So to get there from Awareness stage 1 we talk about creating a personal Wealth Wednesday Automated Success Framework. This is actually very simple and consists of organizing your financial affairs into 3 “Pots” and automating regular payments into each pot. And then managing the efficiency of each Pots. The 3 Pots are;

- Pot 1: Pension Pot

- Pot 2: Bad Debt Pot

- Pot 3: Savings Pot

After you have automated contributions into each of your Pots- you budget and live of the remainder of your income.

The majority of people unfortunately have their finances all over the place – a bit like this.

We want our Wealth Wednesday graduates to have a Wealth Wednesday Automated Success Framework that looks more like this.

Planning: So how much to put in each Pot?

This is obviously an individual decision and we have sections on the Blog here dedicated to each Pot- the first point is to sit down and do your personal Budget and review current situation. For example someone may have a lot of Pot2: Bad Debt and therefore have to put quite a bit into this which may limit their ability to contribute to Pot1: Pension or Pot3: Saving. However if after restructuring their Pot 2:Bad debt they may free up more cash to enable more to go into their other pots. So as things change someone may get a promotion/payrise/commission etc and reconfigure their Framework payments/contributions into their 3 pots.

The Key point about completing Stage 2 is that you have set up the framework – and automated your contributions/payments. The amounts you contribute are important but getting your framework set up and committing to monitoring it monthly is the crucial element. Once you have your framework in place you are in good shape to monitor each Pot monthly and try and make each Pot work as hard for you as possible and give you the best return on investment.

So in our Wealth Wednesday Workbook these are the tasks to complete in order to complete Stage 2 and get to achieve Wealth Wednesday Financial Intelligence Stage 5 “Financial Control”

- Read: The Automatic Millionaire – and post key learning’s onto WW blog

- Do your personal budget (on Xero? spreadsheet or other tools)

- Review and understand Wealth Wednesday Automated Success Framework- The 3 key pots: Pension, Saving, Bad Debt reduction.

- Put together plan- how much to each pot? set targets for each pot.

- Pension Pot: set up pension account ( Hargreaves SIPP or similar)- Set up automated contribution of £____________

- Bad Debt Pot: consider restructuring if required -shop around – can efficiencies be made to reduce overall interest liability. Set up automated repayment of £___________

- Savings Pot: (ISA’s, Zopa etc) set up a savings account – automate monthly payments of £__________