The Automatic Millionaire, written by David Bach illustrates the key principles and benefits of an automatic savings mentality. The book demonstrates that by making your savings automatic, you can achieve financial freedom; and with the right returns become or get close to becoming a millionaire.

Key Principles

(1) Control Your Outgoings

To begin with you need to recognize that the most important thing that matters when it comes to money is how much you spend rather than what you earn!

(2) Everyone Can Save

Could you spare a couple of pounds each day?

In the book there is a clever example described as ‘The Latte Factor’ proving that everyone can save. This concept illustrates that if you were to give up your daily coffee and a bun from Starbucks or wherever and instead invested the £3 that you would have spent each day, you would end up with roughly over £200K in 30 years time (£500K+ in 40 years time), i.e. the time when you come to retire. NB. This figure is based on an annual return of 10% on your investment but the principle is very interesting.

Bach isn’t saying never have a take away coffee and bun again in your life, as we all need to self indulge, HOWEVER, what he is saying is, if you are willing to spoil yourself each day, why not invest the same in your retirement as well or instead; and hence think twice about your spending.

Bach isn’t saying never have a take away coffee and bun again in your life, as we all need to self indulge, HOWEVER, what he is saying is, if you are willing to spoil yourself each day, why not invest the same in your retirement as well or instead; and hence think twice about your spending.

The same example can be applied to any consumer luxury item, e.g. cigarettes; have you considered how much you spend on these each week, month, year?!

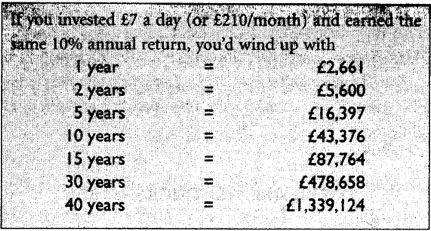

Further examples of giving up unnecessary daily spending and investing it instead:

Take the Latte Factor challenge now and see for yourself…

Act now by cutting out some non-essential expenditure and start saving today!

(3) Pay Yourself First

For every pound you earn you are paying the government just under half of that pound in Inland Revenue tax and National Insurance.

However, you have a right to avoid paying that tax, legally, by paying yourself first! The way to do this is through a pension scheme which was legally designed by Her Majesty’s Government to encourage saving without paying any tax.

Tax free investments have a huge advantage over regular investments.

Forget about get-rich-quick schemes – Make the commitment to Pay Yourself First!

(4) Make Your Savings Automatic

Rather than relying on you to religiously pay yourself, the best way to save is by making it automatic. If you don’t see it you won’t miss it.

Whether you want to put money into a pension, set up a saving scheme like an ISA, put money aside for a deposit on a house or to pay off a credit card, the best way to do it is by setting up automatic payments.

With a company pension you can arrange things so that your contributions are handled automatically through payroll deduction.

(5) Make Your Money Work For You

It’s all about compound interest! Let your money make you more money.

One example that really hit home with me was seeing the following table. It sounds simple but the earlier you start saving for your future, the better! We can’t all save a huge amount but consider what you can save i.e. what can you do without and use that to secure your financial future!

- Billy started at 15 and invested a total of £15K which earned him £1.6Million

- Susan started at 19 and invested a total of £24K which earned her £1.5Million

- Kim started at 27 and invested a total of £117K which earned her £1.2Million

Billy invested £102,000 less than Kim but has earned £290,585.73 more for his retirement!

NB. Bach states: Returns on all investment products will fluctuate. Investment return and principle value will fluctuate and your investment value may be more or less than the original invested amount.

NB. Bach states: Returns on all investment products will fluctuate. Investment return and principle value will fluctuate and your investment value may be more or less than the original invested amount.

It is important to remember that the above example is a projection only and relies on 10% annual return BUT it is very interesting in terms of the value of starting to save early. Realistically there are not many 15 year olds (outside of LA that is!!) that can save £3K per year, however, it does prove that the earlier you start the better off you will be!

(6) Money For A Rainy Day

Aside from saving for your retirement it is important you also look at your own current savings plan for emergencies. The best way to look at this is to work out the following:

1. MY TOTAL MONTHLY EXPENSES =

2. MY TOTAL CURRENT SAVINGS =

3. NUMBER OF MONTHS WORTH OF SAVINGS I HAVE* =

* i.e. how many months would your current total savings last you based on your current monthly expenses?

The most tax efficient way to save for a rainy day is via a cash ISA. This method allows you to earn interest on your savings. Again by making payments to your ISA automatically, this is the best way to build up a safety cushion big enough to keep money worries at bay.

(7) Wealth Comes From Being Debt Free

Until you become debt free you will never gain significant wealth. If you have credit card debt, mortgage debt or any other kind of debt you need to clear this as quickly as possible before you can get on the road to serious wealth.

Check out Martin Lewis’s website www.moneysavingexpert.com for tips on how to save on all sorts; bills, insurance, shopping, mortgages, credit cards etc.

There are also some clever ways to manage your debt e.g. credit card debt by ‘card tarting’

IMPORTANT: Automatic payments (before tax) plus compound interest, equals serious wealth!